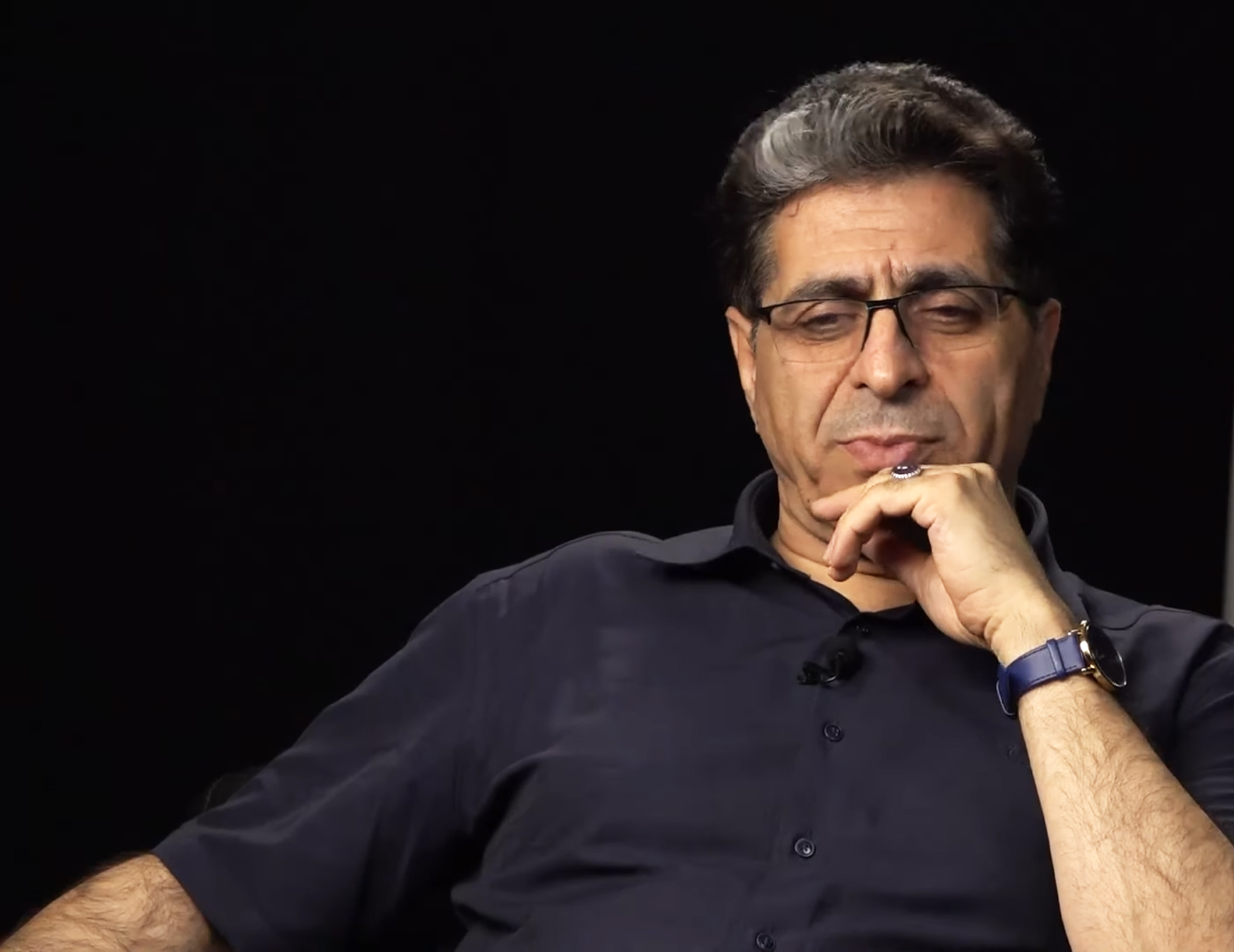

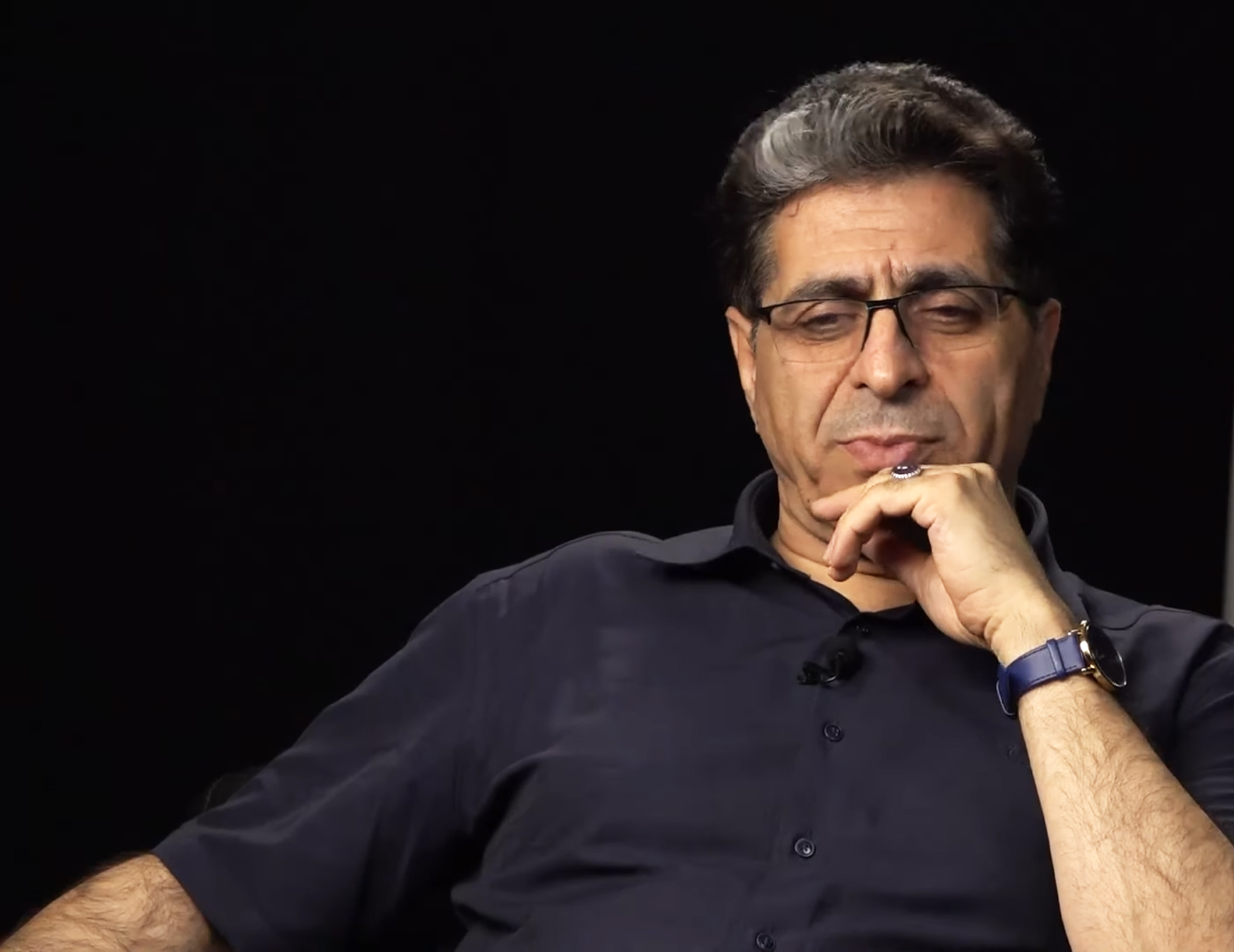

Mohammad Reza Saidi, Chief Executive Officer of Shasta, in a contribution prepared for the inaugural issue of Sadr monthly magazine, elaborates on the fundamental transformation currently underway in the managerial philosophy of this holding company.

According to the Public Relations Department of Sadr Tamin Investment Company (TASICO), Saidi’s note—entitled “Shasta on the Path of a New Orientation: A Transition from Controlling Management to Strategic Shareholding”—presents the following perspective:

“Shasta can no longer be regarded merely as a large-scale economic holding. It has evolved into a strategic institution intrinsically connected to major components of the national economy, the capital market, and the country’s pension system. With an approximate 8 percent share of the capital market and a 2–3 percent contribution to the gross domestic product, Shasta has emerged as one of Iran’s principal economic actors. In this context, the organization has chosen a new trajectory: a movement from operational oversight toward professional, value-driven shareholding.

Although Shasta is legally a subsidiary of the Social Security Organization, its institutional identity cannot be fully aligned with that of state-owned enterprises. As a non-governmental public entity, its core mandate is to secure sustainable financial returns in support of insurance and retirement services. This unique mission increases the need for prudent decision-making, transparency, and robust accountability mechanisms.

Within the framework of this new managerial era, the revival and institutionalization of corporate governance principles have been prioritized as foundational commitments. These principles necessitate transparency, professionalism, and a long-term orientation toward stakeholder interests. Establishing commercial law standards, enhancing the functional authority of boards of directors, promoting the purposeful inclusion of younger professionals, and expanding women’s participation in management constitute key elements of this reform agenda. In this analytical view, Shasta is not solely an economic entity; rather, it functions as a dynamic ecosystem engaged with a wide array of stakeholders—including the public, governmental bodies, regulatory institutions, and the capital market.

Furthermore, the country’s Seventh Development Plan underscores the imperative for non-governmental public institutions to withdraw from direct operational management. Accordingly, as the economic arm of the Social Security Organization, Shasta faces an unavoidable structural obligation to redefine its managerial role. Global comparative evidence reveals that successful pension funds typically concentrate on equity holdings, securities, and liquid assets, rather than on the direct management of extensive corporate portfolios. Nevertheless, Shasta’s historical approach has been characterized by extensive direct control of subsidiary companies.

The time has therefore arrived for the holding to shift decisively from direct ownership and operational intervention toward strategic shareholding. This gradual yet essential transition necessitates a comprehensive reorientation. Notably, forthcoming divestitures will not reflect disengagement or the mere disposal of assets; rather, they will be implemented through a model of committed divestiture—a structured approach that involves transferring managerial responsibilities to specialized firms while retaining equity stakes and capturing sustained value-added benefits.

Shasta’s strategic transformation, however, extends well beyond divestiture. The organization has articulated an “eight-dimensional structural migration,” which encompasses: consolidation from twenty industries to five priority sectors; a shift from operational management to professional shareholding; a transition from non-listed to listed assets; movement from smaller enterprises toward large-scale corporations; transformation from traditional production to technology-driven innovation