Realated posts

A Glance at Brilliant Performance of TASSICO & Subsidiaries in Capital Market

An Increase in Profits Expected for Next Fiscal Year

Sadr Tamin Investment Company (which is known by its stock ticker symbol as TASSICO) had an excellent performance in the fiscal year to March 19, 2024, which shows the value of its share in the capital market.

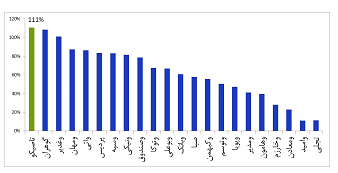

Investments made by TASSICO resulted in a 111-percent return of this stock symbol (which was higher than other parallel markets except for gold). It ranked first among subsidiaries of the Social Security Organization (Shasta) and the second among the competing investment companies. It should be noted that the company’s market value is still upward during the current fiscal year to March 19, 2024, the company’s website reported on Saturday, September 9.

The support program of Sadr Tamin holding for the shares of its subsidiaries in the capital market led to an average growth of 78 percent of the subsidiaries, according to the report. For further details look into the table below;

|

GROWTH (%) |

STOCK SYMBOL |

ROW |

|

56 |

FABAHONAR |

1 |

|

32 |

KAZGHAL |

2 |

|

6 |

KAKHAK |

3 |

|

36 |

SHAMLA |

4 |

|

6 |

KAFRA |

5 |

|

87 |

KALVAND |

6 |

|

197 |

KAPSHIR |

7 |

|

191 |

SHALOAB |

8 |

|

98 |

KASAADI |

9 |

|

70 |

KARAM |

10 |

|

78 |

|

AVERAGE GROWTH OF SUBSIDIARIES |

The value of the shares of the company has been on the rise in the capital market as a result of measures taken including the initial public offering of Ceram Ara Industries Company in March 2023, outlining a plan for the initial offering of Pars Tamin Mines Development Company as a project-based joint stock company, the fundamental analysis of the companies in the stock committee of the holding and purchase and sale of the shares based on the approvals of the stock committee such as buying the shares of the National Iranian Copper Industries Company when its price was at all-time low. The purchase of the shares of the National Iranian Copper Industries Company helped the company gain a return on equity and increased its Dividend Per Share (DPS).

The future profit of the company is guaranteed due to TASSICO’s successful performance and its development plans in the copper and coal industry and adding gold to its stock market portfolio this year. It is predicted that the company’s net profit will increase as high as that of this year. An operating income of $600m is also achievable for TASSICO thanks to its stock market portfolio optimization outlined in its five-year vision to March 19, 2029.